Not known Factual Statements About G. Halsey Wickser, Loan Agent

Table of ContentsUnknown Facts About G. Halsey Wickser, Loan AgentThe Greatest Guide To G. Halsey Wickser, Loan AgentThe 10-Second Trick For G. Halsey Wickser, Loan AgentSome Known Questions About G. Halsey Wickser, Loan Agent.The smart Trick of G. Halsey Wickser, Loan Agent That Nobody is Discussing

The Assistance from a home loan broker doesn't finish once your mortgage is safeguarded. They supply ongoing aid, helping you with any type of questions or problems that occur throughout the life of your car loan - mortgage loan officer california. This follow-up assistance makes sure that you remain pleased with your home mortgage and can make educated choices if your financial circumstance changesSince they function with multiple lenders, brokers can discover a loan product that fits your one-of-a-kind financial situation, even if you have been rejected by a financial institution. This adaptability can be the key to unlocking your desire for homeownership. Selecting to function with a home mortgage expert can change your home-buying trip, making it smoother, faster, and much more economically valuable.

Locating the right home for yourself and figuring out your budget can be incredibly difficult, time, and money-consuming - Mortgage Broker Glendale CA. It asks a great deal from you, depleting your energy as this task can be a task. (https://www.localoffers.direct/united-states/glendale/financial-services/g-halsey-wickser-loan-agent) A person that functions as an intermediary between a consumer an individual seeking a home loan or home car loan and a lending institution usually a financial institution or lending institution

The 10-Second Trick For G. Halsey Wickser, Loan Agent

Their high degree of experience to the table, which can be crucial in assisting you make notified decisions and ultimately attain effective home financing. With rates of interest fluctuating and the ever-evolving market, having actually somebody completely tuned in to its ongoings would certainly make your mortgage-seeking procedure a lot easier, eliminating you from navigating the struggles of loading out documents and carrying out stacks of study.

This allows them provide expert advice on the very best time to secure a mortgage. As a result of their experience, they likewise have actually established links with a large network of lending institutions, ranging from significant banks to specific mortgage carriers. This extensive network enables them to give property buyers with numerous mortgage choices. They can utilize their connections to locate the very best loan providers for their customers.

With their industry understanding and capacity to bargain effectively, home mortgage brokers play a pivotal role in securing the most effective home mortgage bargains for their customers. By maintaining relationships with a diverse network of loan providers, home loan brokers get to several mortgage options. Additionally, their heightened experience, explained above, can offer vital details.

Little Known Facts About G. Halsey Wickser, Loan Agent.

They have the skills and techniques to encourage lending institutions to offer better terms. This might include reduced rate of interest rates, lowered closing prices, and even extra versatile repayment routines (california mortgage brokers). A well-prepared home loan broker can offer your application and monetary account in a manner that allures to loan providers, increasing your possibilities of an effective settlement

This advantage is typically a pleasant shock for many property buyers, as it permits them to leverage the knowledge and sources of a mortgage broker without fretting about incurring additional expenditures. When a borrower protects a home mortgage through a broker, the loan provider compensates the broker with a compensation. This compensation is a percent of the lending quantity and is frequently based upon variables such as the rates of interest and the sort of funding.

Mortgage brokers succeed in recognizing these distinctions and collaborating with loan providers to find a mortgage that matches each consumer's certain requirements. This customized approach can make all the distinction in your home-buying journey. By functioning carefully with you, your mortgage broker can make sure that your car loan conditions straighten with your economic goals and capabilities.

The 30-Second Trick For G. Halsey Wickser, Loan Agent

Tailored home mortgage services are the trick to a successful and sustainable homeownership experience, and home mortgage brokers are the experts that can make it take place. Employing a home mortgage broker to function together with you might bring about rapid funding authorizations. By utilizing their competence in this area, brokers can help you prevent possible pitfalls that commonly create delays in funding authorization, leading to a quicker and much more effective path to securing your home financing.

When it comes to purchasing a home, browsing the globe of home mortgages can be frustrating. Home mortgage brokers act as middlemans in between you and possible loan providers, assisting you find the finest home mortgage deal tailored to your specific situation.

Brokers are well-versed in the intricacies of the mortgage sector and can supply useful understandings that can assist you make informed choices. Rather of being restricted to the mortgage products offered by a solitary lending institution, home loan brokers have access to a wide network of lending institutions. This suggests they can go shopping around on your part to locate the very best finance choices available, possibly conserving you money and time.

This accessibility to several lenders offers you an affordable advantage when it comes to safeguarding a positive mortgage. Searching for the appropriate home loan can be a lengthy procedure. By dealing with a home loan broker, you can save effort and time by letting them handle the study and documents involved in searching for and safeguarding a lending.

Getting The G. Halsey Wickser, Loan Agent To Work

Unlike a financial institution funding officer who may be managing numerous customers, a mortgage broker can offer you with individualized solution customized to your individual requirements. They can put in the time to recognize your financial situation and goals, using tailored services that align with your specific demands. Home loan brokers are experienced mediators that can aid you safeguard the most effective possible terms on your car loan.

Tia Carrere Then & Now!

Tia Carrere Then & Now! Dylan and Cole Sprouse Then & Now!

Dylan and Cole Sprouse Then & Now! Melissa Joan Hart Then & Now!

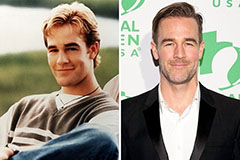

Melissa Joan Hart Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now!